No-Nonsense Tools to Tackle Home Loans—Why Mortgage Advice Really Matters

Ever caught yourself staring at the dozens of mortgage deals out there, wondering which one won’t come back to bite you later? If you call Leicestershire home—maybe you’ve slogged for years to earn what you’ve got, worked overtime for that Bay-windowed semi, or you’re eyeing your first keys in Birstall or Market Harborough—the sheer choice on offer can feel more like a headache than an opportunity. And let’s be honest, it’s not about fiddling some online calculator to spit out a number; it’s about proper mortgage advice that fits your life, not just your spreadsheet.

These days, earning your little patch of England is no easy feat. The housing market’s up and down, rates jump about and jargon gets bandied all over—so you need solid mortgage advice that cuts through the confusion, proper guidance that speaks plain English, not just finance waffle. Because here in the Midlands, people want straight answers, a bit of empathy, and someone who gets that every penny counts. Whether you’re juggling school runs, sorting out your dad’s pension, or putting together that all-important deposit, the right mortgage advice could mean faster peace of mind and a deal that won’t let you down. No fuss, no airs and graces—just real solutions for real people in Leicester and beyond.

Finding Your Feet in the Mortgage Maze—Why Proper Advice Changes Everything

Mortgage advice isn’t just about picking the cheapest deal flashing at the top of the screen, and it’s not something to bash out over a cuppa and forget about, either. For most working people across Leicestershire’s suburbs—whether you’re in Loughborough terraces or a sunny bit of Melton Mowbray—securing a mortgage is the biggest financial step you’ll take. Get it wrong, and you could be shackled to years of hefty repayments or stuck with a lender who’s all stick and no carrot. It’s not about fault—let’s face it, the market’s as clear as mud and everyone’s had to graft harder lately just to keep up. That’s why direct, unbiased mortgage advice—tailored to your own story—matters so much more than a generic number crunch from a website.

Without the proper know-how behind you, there’s a real risk of ending up with a mortgage “solution” that’s anything but. It’s easy to overlook options when lenders parade thousands of choices, each with its own fine print, catch, or sneaky charge. Real mortgage advice does more than just dot the i’s and cross the t’s—it helps you understand what you’re signing up for, protects your bigger picture, and makes sure your home isn’t just a dream, but something you can comfortably hold on to. It’s about being seen, understood, and respected—especially by those who know how hard you’ve worked to get where you are. And in a world where everyone’s hustling just to keep afloat, insider knowledge gives you that edge others might never mention.

While navigating the complexities of home loans, it's worth recognising that major life events and broader economic shifts—such as changes in public services or healthcare—can also impact your financial planning. For example, understanding how events like the England doctor strike affect NHS services can help you anticipate potential changes to your household budget or support needs, ensuring your mortgage decisions remain resilient in uncertain times.

Why Local, Unbiased Mortgage Advice Makes All the Difference for Leicestershire Homeowners

Stepping Stones Financial Planning & Solutions, grounded in the heart of Leicestershire, brings something refreshingly different to the table—honest, personalised mortgage advice that never makes you feel like a number. They recognise the thousands of mortgage choices out there, but what they value most is your unique journey, your graft, and your goals. Their approach? Unbiased recommendations truly in your interest, shaped by knowledge of local life, straight-talking conversations, and a team that's as committed to clarity and integrity as you are to getting your bricks and mortar. For anyone in Leicester, Desford, or Loughborough who’s been told “it’s just the system,” their service proves otherwise.

Practical, human advice isn’t just a catchphrase at Stepping Stones—it’s their backbone. They don’t push products, spin jargon, or leave you in the dark. Instead, you'll get honest explanations, second-to-none communication, and hands-on guidance every step of the way. This is especially powerful when you realise the stakes: the wrong mortgage could mean sleepless nights over repayments, the right advice means comfort, security, and pride every time you pull onto your drive—no matter the British weather. Whether you’re arranging your very first loan, or remortgaging to provide a better future for the family, what you get isn’t just financial clarity; it’s the confidence that comes from knowing someone’s got your back and genuinely understands what your home means.

Real-World Impact: Saving Time, Reducing Stress, & Avoiding Costly Mistakes

Most folks in Leicestershire don’t want fancy sales pitches—they want results. The true value of robust mortgage advice is how quickly and smoothly it can help you side-step the snags that have tripped up thousands before you. When decisions are made with a clear head and clear facts, you’re far more likely to zip through the process, get a great rate, and move into your new home or secure that better deal without endless stress. And let's face it: life’s busy enough without chasing firms that never return your call or expecting automated online tools to care about your family's specific needs.

A strong advisor not only finds the right rate—they help you understand every step, flag up the pitfalls hidden in contracts, and make sure you don’t pay more than you need to over the life of your mortgage. For the people who rely on their homes as their castle—those lining up school shoes in the hallway or tending their front gardens after a double shift—it’s about ensuring their effort goes towards something lasting. Mortgage advice isn’t just money, it’s peace of mind baked into every monthly payment.

The Midlands Mortgage Journey: From First Homes to Lifelong Stability

Getting a foot on the property ladder in places like Groby or Market Harborough can feel like a marathon these days—especially if you grew up hearing stories of parents buying their first home for a song. These days, first-time buyers face far more hoops: stricter lending, more paperwork, and a dizzying array of products. The right mortgage advice sets them up not just for that initial purchase, but for financial stability years down the line. No one should feel alone or clueless while sorting one of life’s most important milestones.

For those remortgaging—maybe to release equity for a self-build or to help the next generation get their own place—the process is equally nerve-wracking. Sometimes, life throws a curveball: job changes, bereavement, or sudden expenses. Having an expert on side who treats you like a person, not an application number, helps you make sound decisions under pressure and weather life’s storms with fewer sleepless nights.

It’s Not Just About the Mortgage—Protecting What You’ve Built Matters, Too

Mortgage advice isn’t a one-and-done deal for hard-working Leicestershire families. After all, getting the keys is just the start. From the first chat about affordability to choosing the right protection so neither you nor your loved ones are left exposed if anything goes wrong, full-circle guidance matters. Most people don’t want to talk about risk, but proper advice means you can rest easy knowing your loan, livelihood, and future are as protected as your home.

It’s a long game: picking the right mortgage now could leave you better off five, ten, or twenty years down the line, freeing up cash for holidays in Skegness, generous inheritance, or a little extension for when the grandkids visit. It’s about getting the full picture, not just the quick win.

Stepping Stones Financial Planning’s Approach—Honest Guidance for Real Leicester Folks

Stepping Stones Financial Planning & Solutions has built its reputation on trust, transparency, and putting people at the heart of every decision—deeply rooted in Leicestershire’s community spirit. Instead of fitting clients into boxes, their team takes time to understand individual circumstances, objectives, and the challenges that shape working and middle-class lives around the county. The aim is simple: clear, understandable advice that stands the test of time, bolstered by top-notch service and a friendly voice at the end of the phone.

Their approach is refreshingly old school: no hard sells, no fancy suits, just practical know-how that helps people achieve their best financial outcomes. With state-of-the-art tech and years of hands-on experience, their advice goes beyond just the numbers, covering everything from mortgages to pensions, investments to tax work. Every recommendation is tailor-made, not off the peg, so whether you’re sorting out your next mortgage renewal or navigating a complex life change, you know you’re speaking to folks who get the Midlands mindset—hard graft, real pride, and a belief in doing right by your family.

The difference with Stepping Stones is that you’ll never be left feeling daft for asking questions, nor pushed into anything you don’t need. Their service is built on honesty and long-term relationships, earning loyalty from Leicester’s homeowners who want to feel respected and understood, not patronised or left behind.

Neighbours’ Words: Mortgage Success Without the Hassle

It’s one thing to hear industry talk, but in Leicestershire, people trust what they see right in their own neighbourhoods. Take this bit of feedback from Karen T. —someone who’s been through the wringer with the mortgage process and come out the other side:

I have recently used Stepping Stones to secure me a mortgage. Ellie has worked so hard for me in doing this, it’s been a long hard process, with problems along the way. But she has been working for me every step of the way. So knowledgeable in her field of work. The communication has been so good from her and her colleagues. I can’t fault this company and will continue to use them in the future for insurances, and mortgage renewals. Ellie, thank you so very much, I couldn’t have done this without you.

Having a reliable adviser in your corner who sees you as a fellow neighbour, not just a client, can make all the difference. For families throughout Leicester and beyond, the right mortgage advice doesn’t just stop at getting a mortgage—it’s about building trust and partnership, so you know you’re sorted no matter what happens next.

Local Mortgage Advice—The Backbone of Secure Leicestershire Living

Sorting out your finances isn’t just about scrimping and saving—sometimes, the bravest act is to ask for advice from folks who’ve seen it all before. Proper mortgage advice in Leicestershire gives local families an extra level of security, confidence, and comfort—whether they’re buying their very first home, remortgaging to tackle new ambitions, or planning a safer future for their loved ones. Stepping Stones Financial Planning & Solutions takes pride in championing honest, real-world mortgage advice—built not on selling you products but ensuring you’ve built something that will last. That’s not a sales pitch, just a nod to what really matters: peace of mind for honest, hard-working people who’ve earned every brick.

The housing journey isn’t always smooth—but with local mortgage advice on your side, those roadblocks feel a little less daunting, and that soft midlands light through the window starts to look like home for good.

If you’re keen to future-proof your financial wellbeing and understand how wider changes in the community might influence your homeownership journey, it’s wise to stay informed about local developments. Exploring topics like the impact of NHS service disruptions on Leicestershire residents can offer valuable perspective on how external factors may affect your household’s stability and planning. By broadening your knowledge beyond mortgages alone, you’ll be better equipped to make confident, holistic decisions for your family’s future. Take the next step by connecting with trusted local experts who understand both the financial landscape and the unique challenges facing Leicestershire families today.

Contact the Experts at Stepping Stones Financial Planning & Solutions

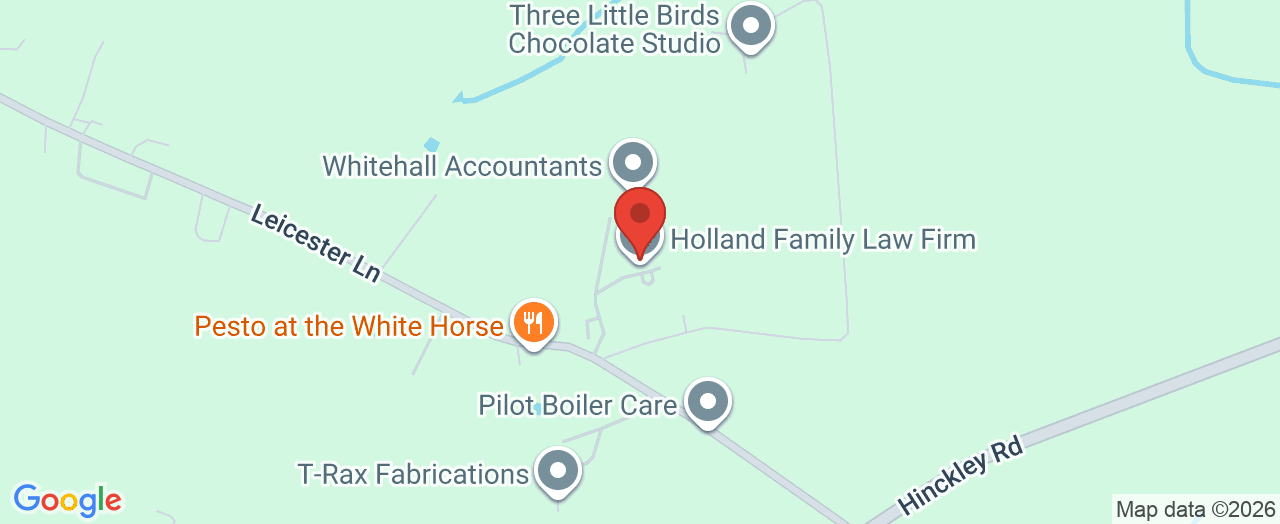

If you’d like to learn more about how mortgage advice could benefit your financial future or streamline your next home move, contact the team at Stepping Stones Financial Planning & Solutions. 📍 Address: Leicester Ln, Desford, Leicester LE9 9JJ, United Kingdom 📞 Phone: +44 116 478 1218 🌐 Website: steppingfp. co. uk

Leicester Location and Office Hours for Stepping Stones Financial Planning & Solutions

🕒 Hours of Operation:📅 Monday: 9:00 AM – 8:00 PM📅 Tuesday: 9:00 AM – 8:00 PM📅 Wednesday: 9:00 AM – 8:00 PM📅 Thursday: 9:00 AM – 8:00 PM📅 Friday: 9:00 AM – 5:00 PM📅 Saturday: 9:00 AM – 5:00 PM📅 Sunday: ❌ Closed

Add Row

Add Row  Add

Add

Write A Comment